- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Articles

- Forex

- EURUSD: EU Recovery Plan and EU’s Frugal Four

News & analysisEU Recovery Fund

After a standoff between the EU and Germany, following a critical ruling on ECB’s quantitative easing program by Germany’s constitutional court, the gradual reopening of economies of member states within the Eurozone has brought some optimism.

The downside risks for the Eurozone and its shared currency have somewhat eased on the fact that Europe, which was the epicentre of COVID-19 after China, might have gone through the worst phase of the pandemic. The sentiment for the Euro was also buoyed by the EU Recovery fund proposed by Chancellor Angela Merkel and President Emmanuel Macron to help Europe’s mostly hit countries.

Unfortunately, the optimism over the coronavirus fund proposal, which aims to show unity in overcoming the crisis and to achieve quicker economic recovery, was short-lived.

Europe’s Frugal Four

Amid an unprecedented crisis, the Franco-German proposal was to provide support and reinforce EU financial relations and show that Europe is standing together. Austria, Denmark, the Netherlands and Sweden, dumbed as the “frugal four” put forward a counter-proposal that highlights the diversion of opinions in helping the Southern members states.

Grants or Loans

The Franco-German proposal is about “overcoming the crisis united and emerging from it stronger”. Both leaders proposed to make outright grants to help countries in need. They want to launch a temporary fund of 500 billion euro for EU budget expenditure:

“This would not provide loans, but rather budget funding for the sectors and regions hit hardest by the crisis. We firmly believe that it is both justified and necessary to now provide funding for this from the European side that we will gradually deploy across several European budgets in the future.”

In contrast, the frugal four wishes to provide loans rather than grants to southern European countries and expect the recipients of loans to comply with the fundamental principles of the EU and commit to strong reforms in repaying the loans. Their two-year and “one-off” proposal appears to also outline how those countries should use the funds and target sectors that are mostly hit based on an assessment.

The coronavirus pandemic is testing the solidarity of European members and is threatening to reawaken a euro crisis. Southern countries like Greece, Italy and Spain lacked the fiscal space they need to put forward an economic stimulus package to support their economies, compared to Northern countries.

Disparity? Compromise?

Both proposals are saying “yes” to emergency aids to assist with recovery, but the disparity lies on how the funds will be financed to respond to the economic wreckage. The size of the emergency fund, the conditions of the funds or whether it will be grants or loans will be a compromise the markets are expecting to see. However, the type of compromise might be a key factor in determining the relationships of EU members.

Unprecedented times probably need unprecedented Unity.

Euro – The Shared Currency

The fact that Europe may have gone through the worst phase of the coronavirus has somewhat eased the downside risks of the shared currency. But the current geopolitical tensions with China and uncertainties on the EU Recovery plan are putting a lid on the upside momentum of the Euro.

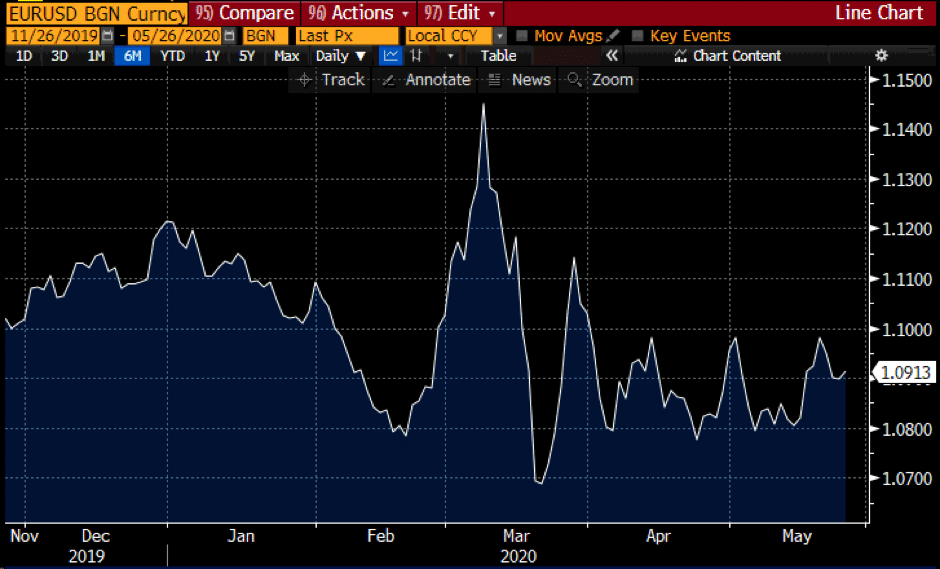

After the sharp plunge in March, the EURUSD pair has been trading within the 1.08 to 1.09 range. Yesterday, the better-than-expected IFO Surveys in Germany has helped the pair to hold ground and hover around the 1.09 level. The recovery plan could mitigate the selling pressure and allow a probable move above 1.10 level if there is a compromise that satisfies the frugal four.

EURUSD

Source: Bloomberg Terminal

The immediate attention turns to the European Commission which is supposed to unveil a draft recovery plan on May 27th, 2020.

About GO Markets

GO Markets was established in Australia in 2006 as a provider of online CFD trading services. For over a decade, we have positioned ourselves as a firmly trusted and leading global regulated CFD provider.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Inner Circle video – INNOVATION: Creating a NEW trading system

Please find below the video recording from this weeks Inner circle session “INNOVATION: Creating a NEW trading system”. Please send any comments or questions to [email protected] Also note the disclaimer at the beginning of the video Mike Smith Educator GO Markets Disclaimer The articles are from GO Markets analysts ...

May 27, 2020Read More >Previous Article

Cognitive Trading Biases: #2 – Minimalisation bias

In a previous article we addressed the concept of cognitive trading biases as a barrier to potential successful implementation of a trading ...

May 24, 2020Read More >Please share your location to continue.

Check our help guide for more info.