- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- EUR continues to tumble as energy crisis worsens

News & analysisThe Euro has fallen to 20-year lows as it deals with increasing energy prices and increased bond yields as recession fears rise again. Across both the UK and Europe inflation has been especially high even compared other countries such as Australia and the USA and in response, the EUR has taken a large hit. The recent spike in energy prices has brought back fears into the market that inflation has not yet peaked and will continue to rise.

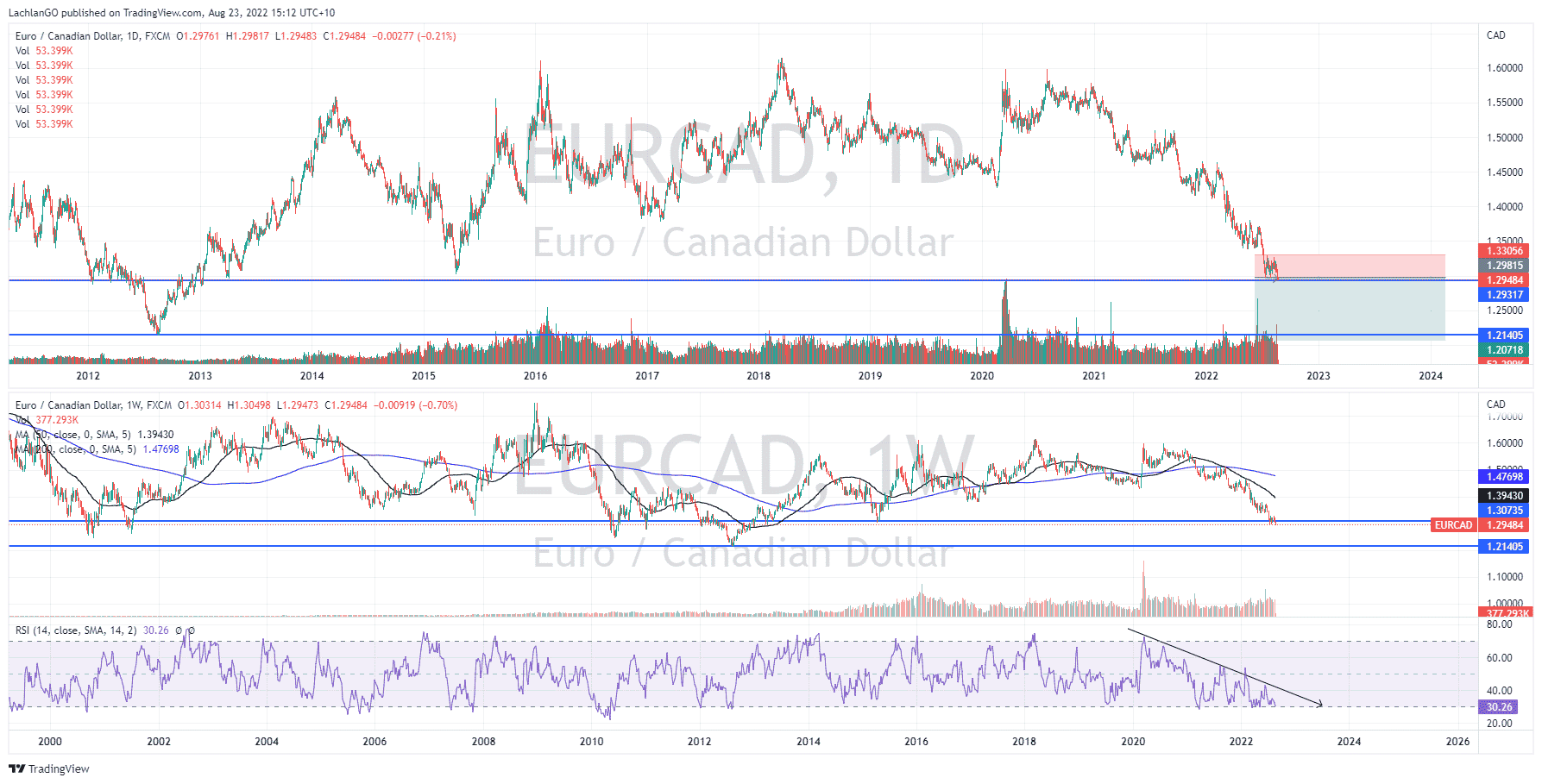

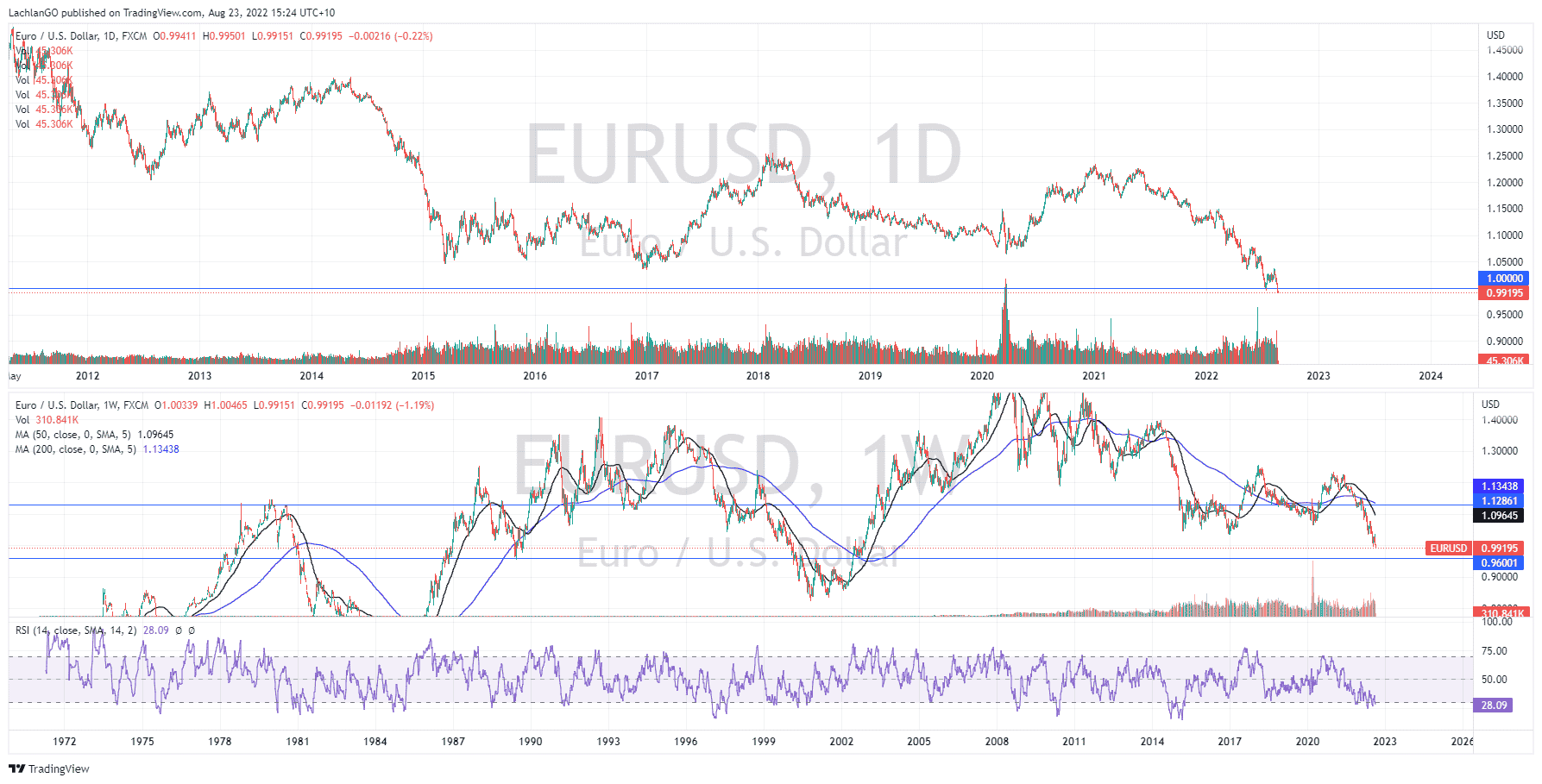

Two potential opportunities are on the EURCAD and the EURUSD.

Firstly, on the EURCAD the price is sitting just above its long term supports and its lowest levels since 2015. With seemingly no fundamental reason for the price to bounce in the short to medium term, it is possible the price sells through the 1.30 CAD level and falls further to the 1.21/1.20 level. The 50-week moving average is almost in a free fall as the currency continues to sell. In addition, the RSI, whilst in oversold territory, is forming a descending triangle. This indicates that sellers may be gearing up again to begin another move down below the 30 RSI level.

Whilst the EUR continues to be smashed there is always the potential that the market will see value and see a rally in the pair. Therefore, it is important to have risk management tools in place such as a stop loss. A stop loss could be set above 1.32 which would represent a potential risk reward of almost 2.5:1.

The EURUSD is following is showing an even more aggressive sell off. The EUR has fallen to 20-year lows vs the USD. The worrying sign is that the price has faced very little resistance since it began diving in January 2022. Every long-term support has been sold through with without much of a pullback. With the 1.00 USD level expected to be a tougher level to sell through, short opportunities still exist. The next level of support is around 0.95/0.96 USD which is the next logical target for a short entry. However, once it reaches this level, it may prove very difficult to fall lower as it would me mean breaching 50 year low prices.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

XPeng results are here – the stock price is falling

XPeng Inc. (XPEV) reported its unaudited Q2 financial results on Tuesday. The Chinese electric vehicle company reported revenue of $1.11 billion for Q2 (up by 97.7% from Q2 2021) vs. $1.09 billion expected. World’s 27th largest automaker reported a bigger loss per share than expected at -$0.47 loss per share for the quarter vs. -$...

August 24, 2022Read More >Previous Article

Zoom reports Q2 results – the stock dips

Zoom Video Communications Inc. (ZM) reported its latest financial results after the market close on Wall Street on Monday. The US communications te...

August 23, 2022Read More >Please share your location to continue.

Check our help guide for more info.