- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- “Deflationary process has begun” as Federal Reserve increase Funds rate by 25 bps

- Home

- News & analysis

- Forex

- “Deflationary process has begun” as Federal Reserve increase Funds rate by 25 bps

News & analysisNews & analysis

News & analysisNews & analysis“Deflationary process has begun” as Federal Reserve increase Funds rate by 25 bps

2 February 2023 By GO MarketsThe US equities market has had a sharp rise to end the trading session as the Federal Reserve announced a 25-bps interest rate rise. Whilst the market had mostly priced in the 25-bps rise, it was the associated commentary that gave the market a boost.

Fed Chairman, Jerome Powel made it clear in his statement and press conference that the Fed is not finished with its hikes and will likely have to continue for some time. This disappointed some traders who were hoping for a quicker pause of rate hikes. It also means that there may be a little while longer until there will be relief for companies and homeowners in the USA. However, Powell did contradict himself as he announced in the press conference that “For the first time, we can declare that a deflationary process has begun.” This led to sharp jump in the major Indices as the market took this as a sign that inflation has peaked.

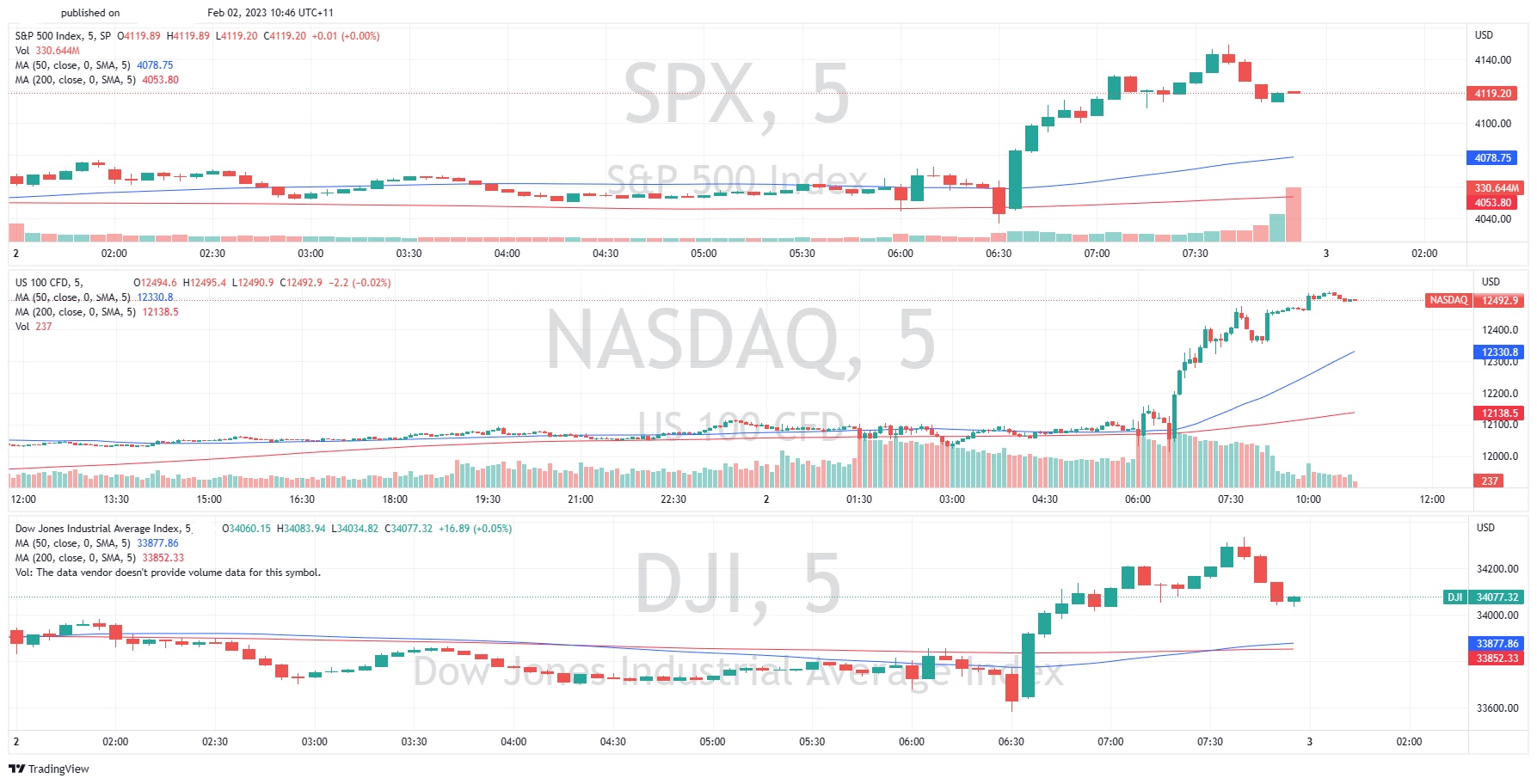

As stated above this acted as a positive catalyst for the market which spiked after Powell’s press conference. The Nasdaq ended the day up 2.00%, the S&P500 1.05% and the Dow Jones Index 0.02%. With more employment data to be released before Friday’s trading session there is still room for more volatility if the figures come out different to expectations. The expected hourly earnings increase for the month is 0.3%, a 190,000 increase in Non-Farm Employment change and an increase to 3.6% unemployment. If the figures show a lack of growth and increase in the unemployment figure it bodes well for equities and a weaker USD.

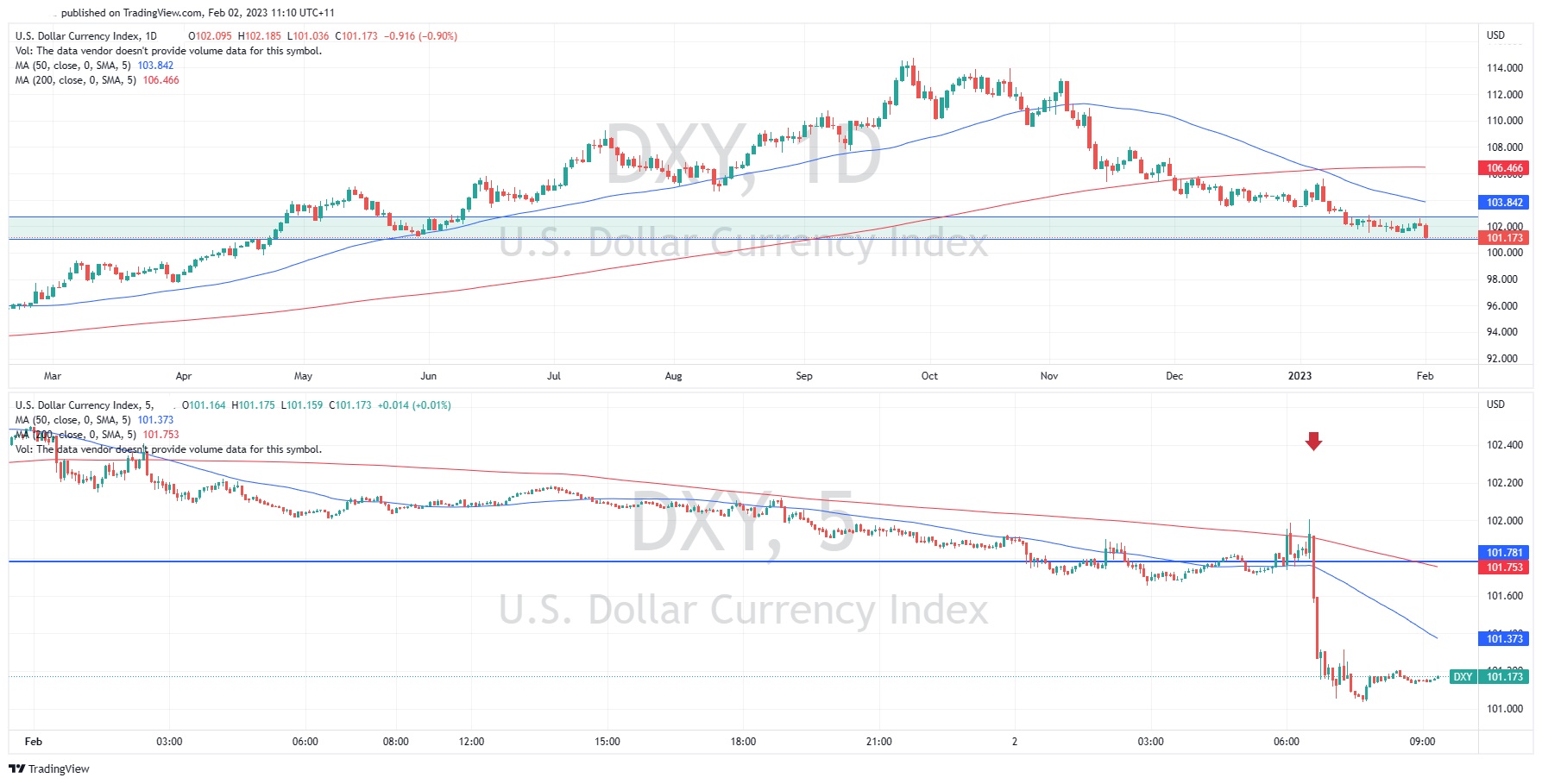

The USD took a large hit on the news and is currently testing its long-term support at 100. The next few weeks could be crucial in determining which direction the USD will go. If risk sentiment continues to improve then it may fall through the support on the other hand if volatility increases and the market becomes weary, the price may bounce to the upside.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Gold Reverses from 1960 following strong US NFP data

Gold had been on a steady rally to the upside with the price climbing along the bullish trendline from the 1620 price level in November 2022 to reach a high of 1960 in February 2023. This move higher was driven by general market anticipation that the US Federal Reserve would pivot on its current monetary policy, slowing down or pausing future inter...

February 6, 2023Read More >Previous Article

EUR looking to continue its bullish trend ahead of FOMC and ECB meeting

The EUR has been on a run since it bottomed in September 2022. From that time, the price is up almost 15% and is currently trading at 1.0863. However,...

February 1, 2023Read More >Please share your location to continue.

Check our help guide for more info.