- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- China Yuan’s Falls to Record lows

News & analysis

I have recently written a piece on the weakening of the Great British Pound (GBP) just the other day, as it looks like the dollar seems to be king at present and getting stronger against all other top currencies around the world. Today is the Chinese Yuan in focus, yesterday was the Sterling pound, who’s your money on tomorrow? We will have to wait and see on that front, but lets quickly dive into why is the Chinese Yuan falling to record lows against the dollar?

The offshore yuan depreciated past 7.2 per dollar, sinking to its lowest levels since data on offshore trading became available in 2011, dragged down by a strong dollar amid expectations for more Federal Reserve rate hikes and a widespread risk aversion in the markets. The yuan also weakened despite efforts by authorities to arrest its slide which are so far having limited impact. In the latest developments, the People’s Bank of China raised the foreign exchange risk reserves for financial institutions when purchasing FX through currency forwards to 20% from the current zero starting on Sept. 28th, making it more expensive to bet against the local currency. A gloomy domestic outlook also weighed on China’s currency, with Nomura and Goldman Sachs slashing their 2023 economic growth forecast for China sharply, predicting Beijing will stick to its strict zero-COVID strategy well into next year.

China’s yuan recovered slightly after falling to a 14-year low against the $$$ Wednesday despite central bank efforts to stem the slide after U.S. interest rate hikes prompted traders to convert money into dollars in search of higher returns.

At one point, the yuan fell to 7.2301 to the dollar, its lowest level since January 2008. One yuan was worth about 13.8 cents, down 15% from its March high.

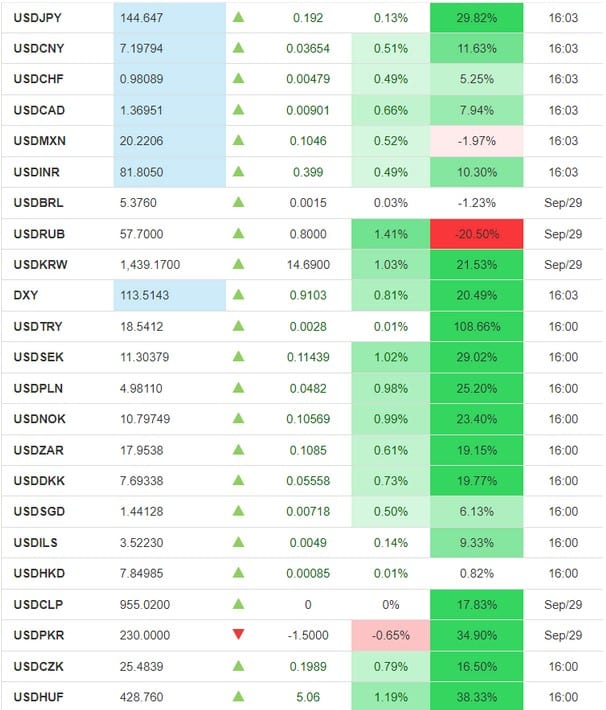

As you can see below, the FEDs strategy has reinforced strength in the dollar, a currency that has been rising to records highs, is now contributing to economic pains in various jurisdictions around the world making more expensive for countries such as China, Japan and UK to name a few, to spend more on importing and making their debt even harder to manage, as they also try to keep on top of inflation by raising interest rates which in turn puts off investors who are looking for value in the market; followed by a run on certain currencies as seen with the GBP to bring it to parity (well almost) with the USD.

The Dollar Against the World Currencies (As of 16:40 AEST 29/09/2022)

There have been ample opportunities to get involved in the FX markets of late, if it’s not buying the dollar, it is to sell other currencies against it, but tread carefully markets are volatile and a sense of trading responsibly must be heeded. If you would like to study the trends and take advantages of entry opportunities, you can do so by opening an MetaTrader trading CFD account with GO Markets here or find our contact details in the footer below.

Sources: fortune.com, tradingeconomics.com

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Reserve Bank of Australia surprises the market by lifting cash rate by 25 bps

The Reserve Bank of Australia, (RBA) has surprised much of the market by raising the country's cash rate by just 25 basis points. With analysts expecting a more aggressive 50 bps hike, the smaller lift will provide relief to much of the country's housing market and equity market. RBA, Chairman, Phillip Lowe outlined how previous rate rises had alre...

October 4, 2022Read More >Previous Article

Tesla sets a new record

Tesla Inc. (NASDAQ: TSLA) reported its Q3 2022 delivery numbers on Sunday. World’s largest automaker delivered a total of 343,830 cars (up by 42....

October 4, 2022Read More >Please share your location to continue.

Check our help guide for more info.