- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Articles

- Forex

- Charts to watch in the week ahead – AUDUSD, Gold, Oil

- Home

- News & analysis

- Articles

- Forex

- Charts to watch in the week ahead – AUDUSD, Gold, Oil

News & analysisNews & analysis

News & analysisNews & analysisGlobal markets head into the new week with one eye on ongoing geopolitical pressures and one eye on US data and comments from Federal Reserve members as we come into the last week before the blackout period ahead of the November 2 FOMC meeting. Along with the geopolitical backdrop there is some key scheduled data this week the traders will be watching with keen interest.

These are the markets I’ll be watching especially closely this week.

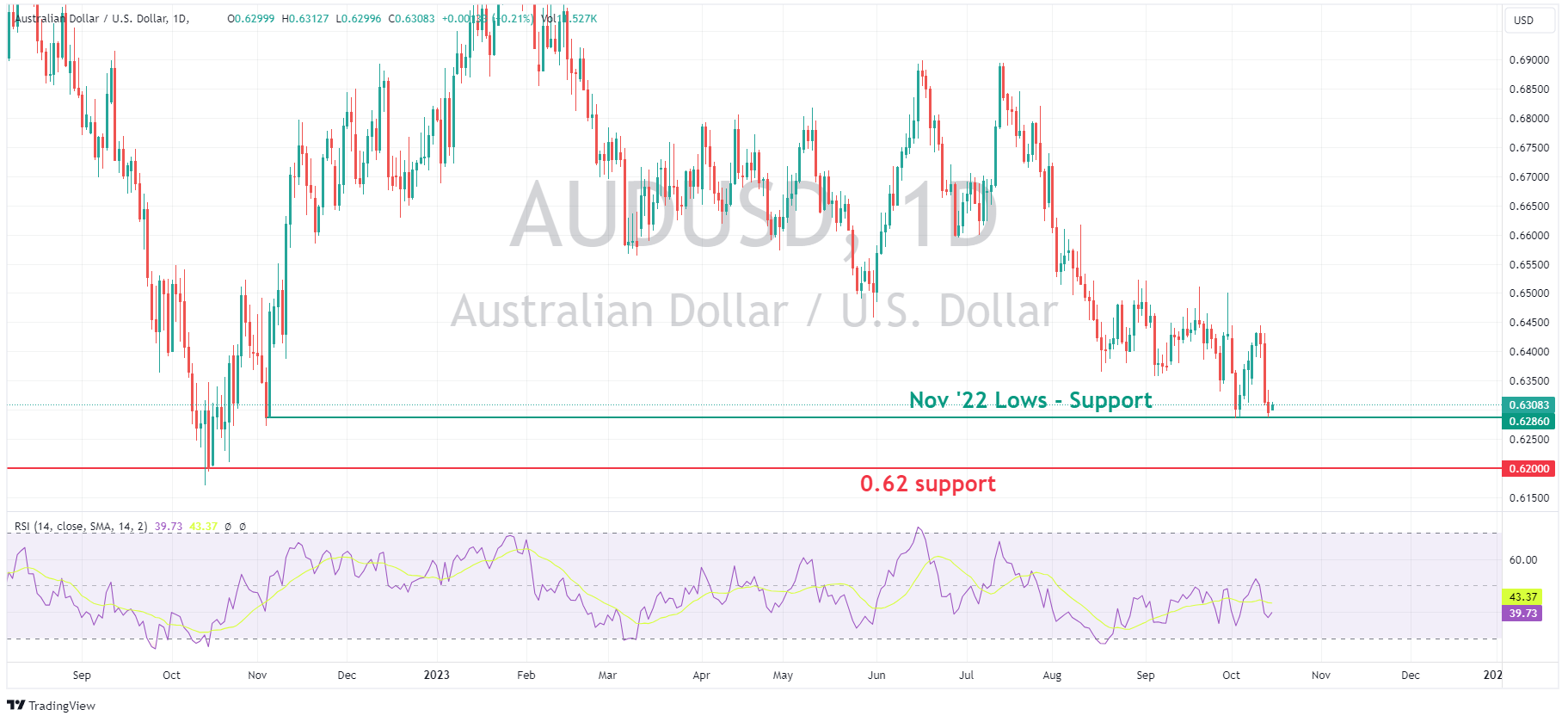

AUDUSD

The Aussie had a tough week as risk sentiment soured somewhat in global markets, and an announcement of Chinese stimulus disappointing the market in its scope. AUDUSD did find good support at the November ’22 lows of 0.6280, a level which has now become key for AUDUSD bulls, a break here has a chart with fresh air until the major 0.62 support level.

Aussie watchers this week have a talk by new RBA Governor Bullock and Australian Employment data to look forward to, along with some important data from the US including retail sales and unemployment claims.

Market sentiment will also play a part in the performance of the risk sensitive AUD.

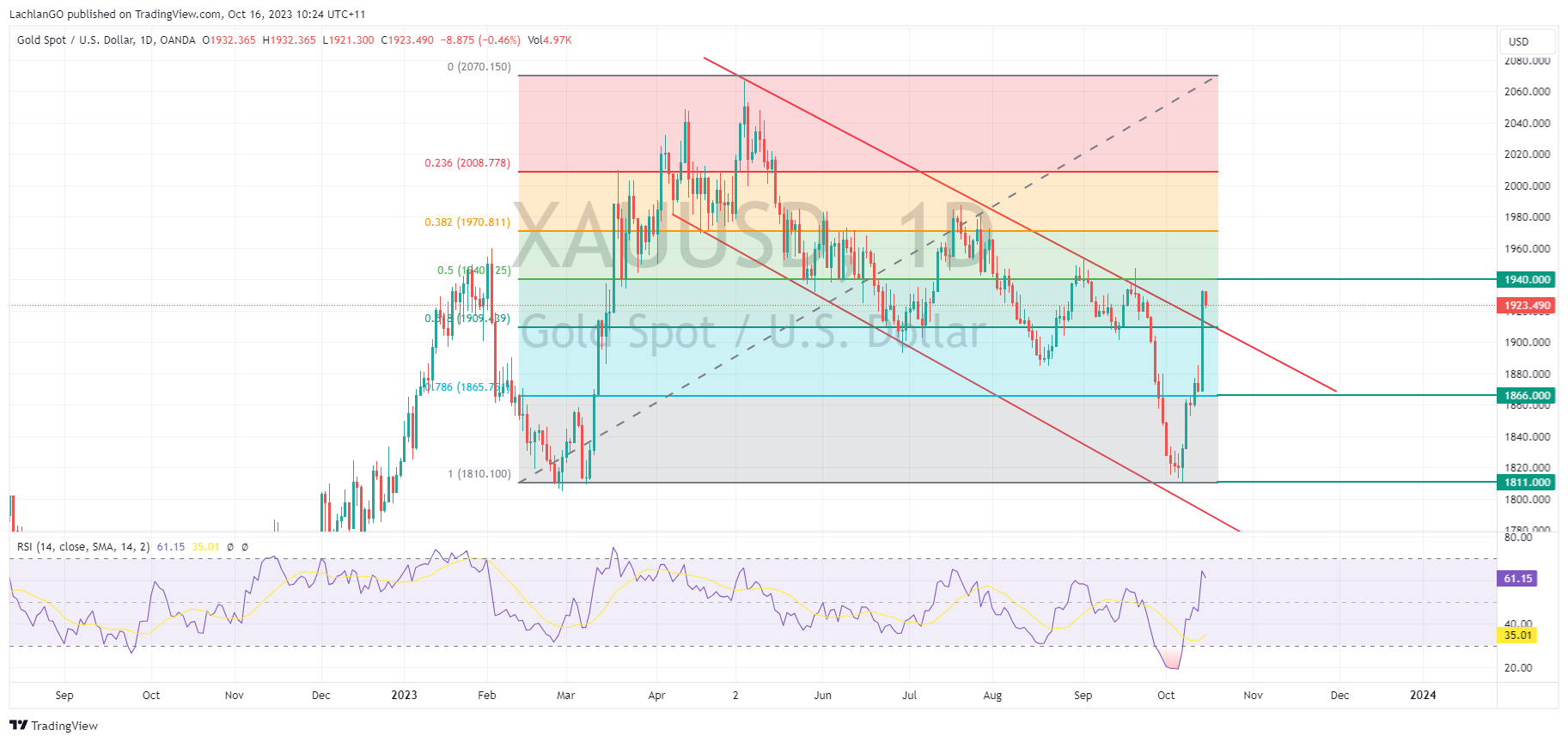

Gold

Gold benefitted from its safe haven status, strongly rallying all of last week with XAUUSD finishing up around 5% for the week. There was a monster push higher on Friday, with a similar move in the Oil market as traders rushed to exit shorts before the weekend in both markets. XAUUSD pushed up to its 50% Fib resistance level at 1940 on Friday, today in the APAC session we have seen a modest pullback as presumably some safe haven traders are unwinding longs. Key levels to watch this week will be the 1940 level to the upside, a break and hold here would point to a technical leg higher, to the downside, the 1905 Fib, mid-September lows and upper trend channel support level all pretty much line up and will be an important area of support if XAUUSD is to hold last week’s gains.

Oil

WTI Crude oil had a choppy and volatile week, pushed and pulled around by conflict in the Middle East and oil storage data. A gap open higher on Monday retraced during the week until, like Gold, a monster move higher on Friday with no-one wanting to be short going into the weekend and the unknowns of the continued conflict.

After recently breaking the medium term trendline that had been in play since July. USOUSD has found this level now become resistance at around the 88.10 USD a barrel level and is shaping to be a key level to the upside. To the downside the gap fill support level at 83.20 will the support level to watch.

Beyond the charts geopolitical events will also play a significant role in Oil price movements this week.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Bitcoin provides traders with some volatility as price continues to trend north.

Bitcoin traders had some excitement in the session overnight, with some false news sending price rising over 7% in a few minutes. A tweet from a well-known crypto news website, Cointelegraph, stated that the SEC had approved a Bitcoin Spot ETF from BlackRock. Markets temporarily rallied off the back of this news, until it was quickly squashed...

October 17, 2023Read More >Previous Article

FX Analysis – USD and yields surge on hot CPI, Gold down, AUD and NZD pummelled

USD surged higher on Thursday, with DXY having its second biggest daily gain since March, reclaiming the big figure at 106 and holding above its trend...

October 13, 2023Read More >Please share your location to continue.

Check our help guide for more info.