- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- AUD analysis – waiting for a catalyst – range trading and mean reversion opportunities

- Home

- News & analysis

- Forex

- AUD analysis – waiting for a catalyst – range trading and mean reversion opportunities

News & analysisNews & analysis

News & analysisNews & analysisAUD analysis – waiting for a catalyst – range trading and mean reversion opportunities

18 May 2023 By Lachlan MeakinThe Aussie dollar has been fairly directionless since late February with it seemingly waiting for a catalyst to break it’s ranges and take the next leg up or down, data this week has failed to provide that. This opens up a couple of very good opportunities for traders, range trading the AUDUSD and mean reversion trades on the AUDNZD.

Starting with AUDUSD, we’ve seen a very strong and tight range develop between a high of 0.6818 to a low of 0.6564 since late February, with the AUD moving in unison with risk sentiment, recently a push lower in this pair has been driven by US debt ceiling concerns, and haven flows into the USD.

Using an equidistant four-part grid the buy and sell zones to take advantage of this range trading opportunity become clear. While this range continues, buying in the green zones and selling in the red zones has so far been very successful.

This looks likely to continue while the aforementioned US debt ceiling impasse remains in place, though traders will need to be on top of any developments, a resolution is likely to see risk roar back and the AUD take a leg up.

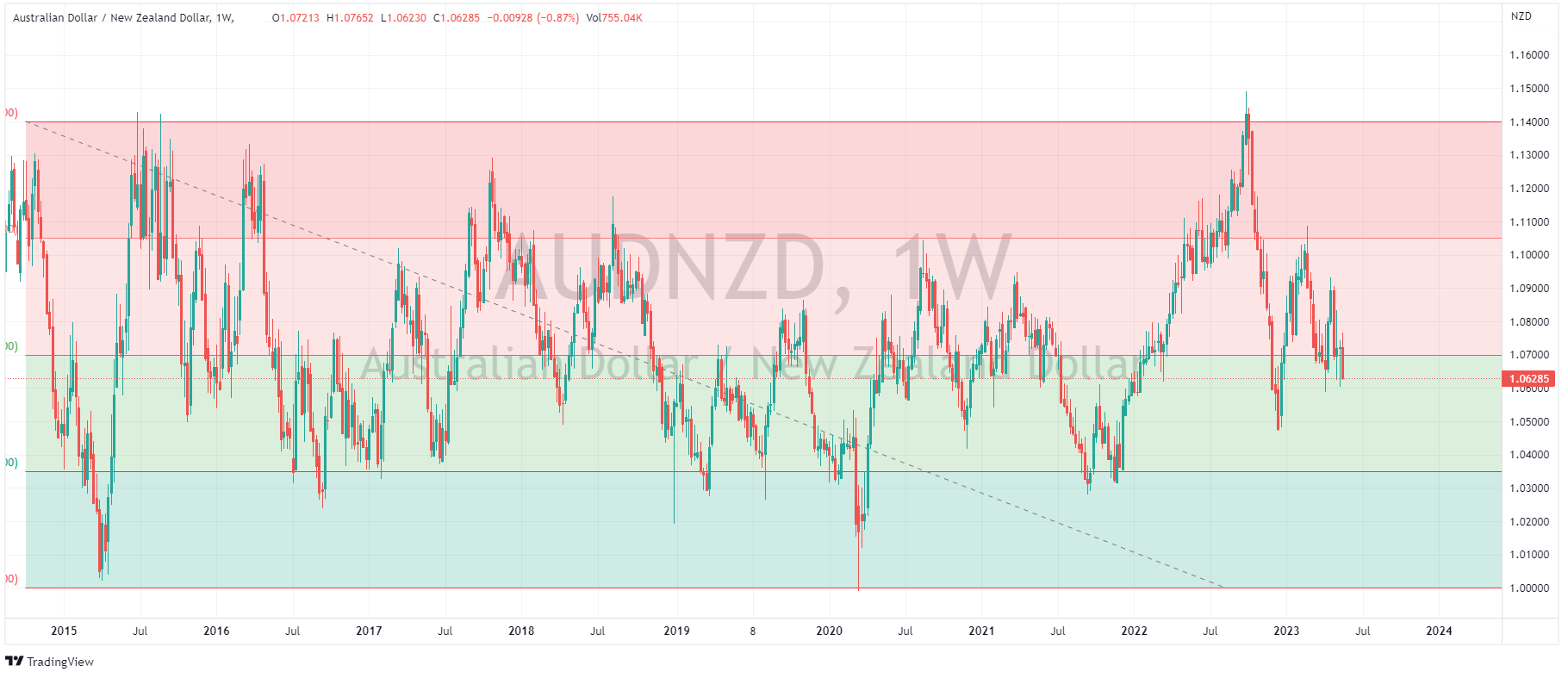

The other opportunity is the relative underperformance of the AUD vs its close neighbour, NZD. This has seen AUDNZD drop below its 10 year mean of 1.07, giving mean reversion traders an opportunity to buy this pair at a discount.

Weekly chart of AUDNZD, showing how this mean reversion trade has worked over the last 8 years.

To help with entries, a shorter time frame chart can be used, below is the 4-hour chart showing a strong support zone has formed between 1.0650 – 1.0580 during the last month, where price has tested on multiple occasions before moving back to the 1.07 level.

These are two of my favourite trading styles I’ve used over the years, but as always, have an exit plan and keep aware of macro happenings if you are looking to incorporate this style of trading into your toolbox.

AUDUSD – US debt ceiling negotiations

AUDNZD – RBA and RBNZ rate expectations

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Market Analysis 22-26 May 2023

XAUUSD Analysis 22 – 26 May 2023 The gold price outlook is generally positive in the medium term. Although the close of last week's sell pressure bar indicates a significant loss of buying momentum, due to the sell-off during the week but the price is still moving above the 1960 support. After the adjustment has come down to test, the ...

May 23, 2023Read More >Previous Article

Market Analysis 15-19 May 2023

XAUUSD Analysis 8 – 12 May 2023 The gold price outlook is generally positive in the medium term. Although the close of last week's sell p...

May 18, 2023Read More >Please share your location to continue.

Check our help guide for more info.