- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Oil continues to fall amid news of price cap

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Oil continues to fall amid news of price cap

News & analysisNews & analysis

News & analysisNews & analysisThe primary reason for the drop in price is the economic slowdown that has become prevalent in the global market. As fears of a recession continue to grow, the price of Oil has continued to drop. To make matters worse, the G7 have set a $60 per barrel price cap. This price cap was created to restrict Russia’s ability generate revenue from its oil exports by making the G7 Oil more competitive. From a fundamental perspective this may push the price lower towards the price cap. On the contrary, Russia has threatened to reduce its supply which would force the price to rise. The situation remains volatile and subject to geopolitical shifts.

From a technical perspective the price of Brent Oil is now at its lowest level for the year and below the levels prior to the Russia and Ukraine war. The price is also now well below the 200 day and 50 day moving averages and is dropping at a fast rate. The price is currently resting on the $76 support levels with the next point of support at $70. If this level fails, as stated above the logical support is $60 based on the price cap. It is also interesting to note that the price of Brent is at its lowest RSI level since December 2021. In recent times every time since 2022, it has been this low the price has bounced in the short term. On the weekly chart, the price is very similar although the RSI has more room to go before it hits the oversold level. This indicates that there may be more of a sell off before a bounce occurs.

With global volatility still high and fears of a recession continuing to grow, the price of oil may continue to fall.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#SpotGold #SpotSilver #GoldTrading #SilverTrading #SpotWTICrudeOil #WTICrudeOil #SpotBrentCrudeOil #BrentCrudeOil #OilTrading #Commodities #CommoditiesTrading #CommodityMarket #CommodityTradingNext Article

Is the price of Brent finally finding some support?

Brent oil has been dumping over the last few weeks as country’s have put pressure on Russian oil by imposing a price cap. This has sent the spot price down to its lowest level in 12 months. With important economic data to come in the next few days in including updated Cash rates from Central banks in Europe, the UK, and the USA. Furthermore, the ...

December 13, 2022Read More >Previous Article

Is the SP500 ready for next move down?

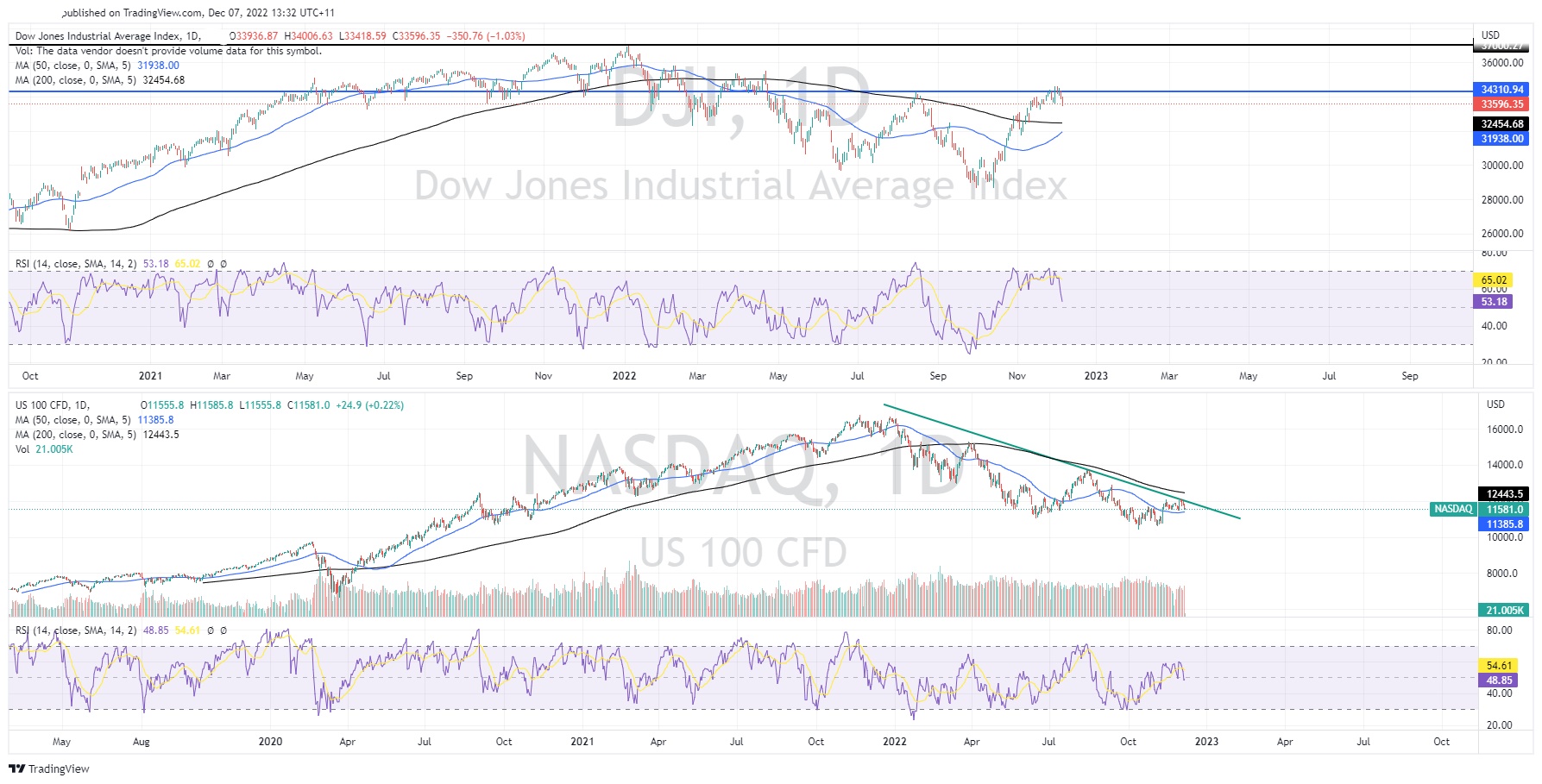

The major American Indices have begun the last month of the year with in an extremely bearish state as recessionary fears rise to the surface again. W...

December 7, 2022Read More >Please share your location to continue.

Check our help guide for more info.