- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

Open Account

CFD trading

Trade CFDs on forex, commodities, indices, and more.

Open accountTo open a CFD trading account as a Company, Trust, or SMSF, apply here.

Share trading

Invest in shares and ETFs on the Australian share market.

Open accountOpen a Personal or Company/Trust/SMSF share trading account.

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- FX analysis – USD decline continues post FOMC, JPY outperforms on probable BoJ intervention

- Home

- News & analysis

- Forex

- FX analysis – USD decline continues post FOMC, JPY outperforms on probable BoJ intervention

News & analysisNews & analysis

News & analysisNews & analysisFX analysis – USD decline continues post FOMC, JPY outperforms on probable BoJ intervention

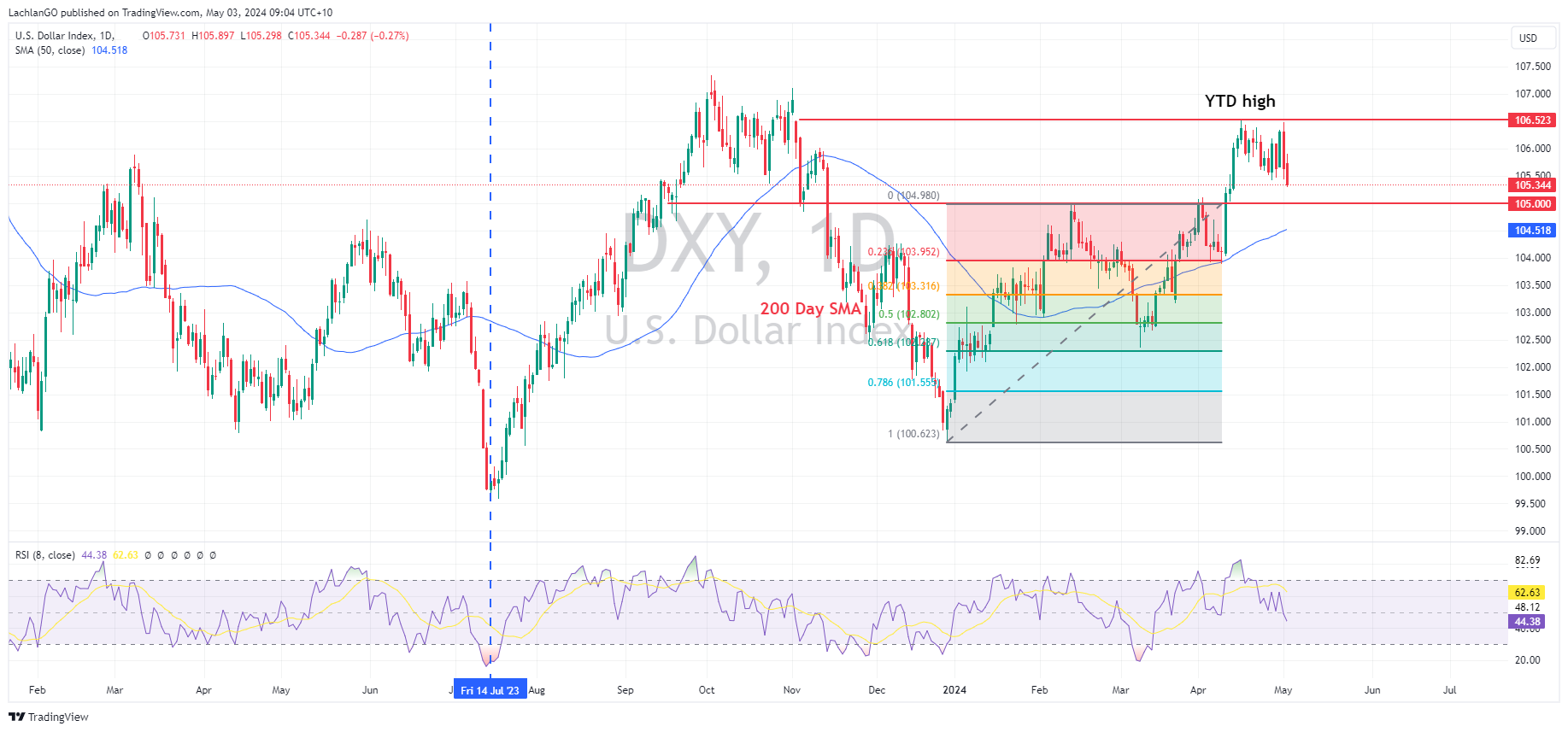

3 May 2024 By Lachlan MeakinUSD continued the move lower sparked by a somewhat dovish Powell in Wednesdays FOMC meeting. And ahead of today’s key NFP print. DXY did hit highs after hot labour costs data, though quickly reversed to hit 3-week lows of 105.29, closing at session lows and looking to test the major support at 105.

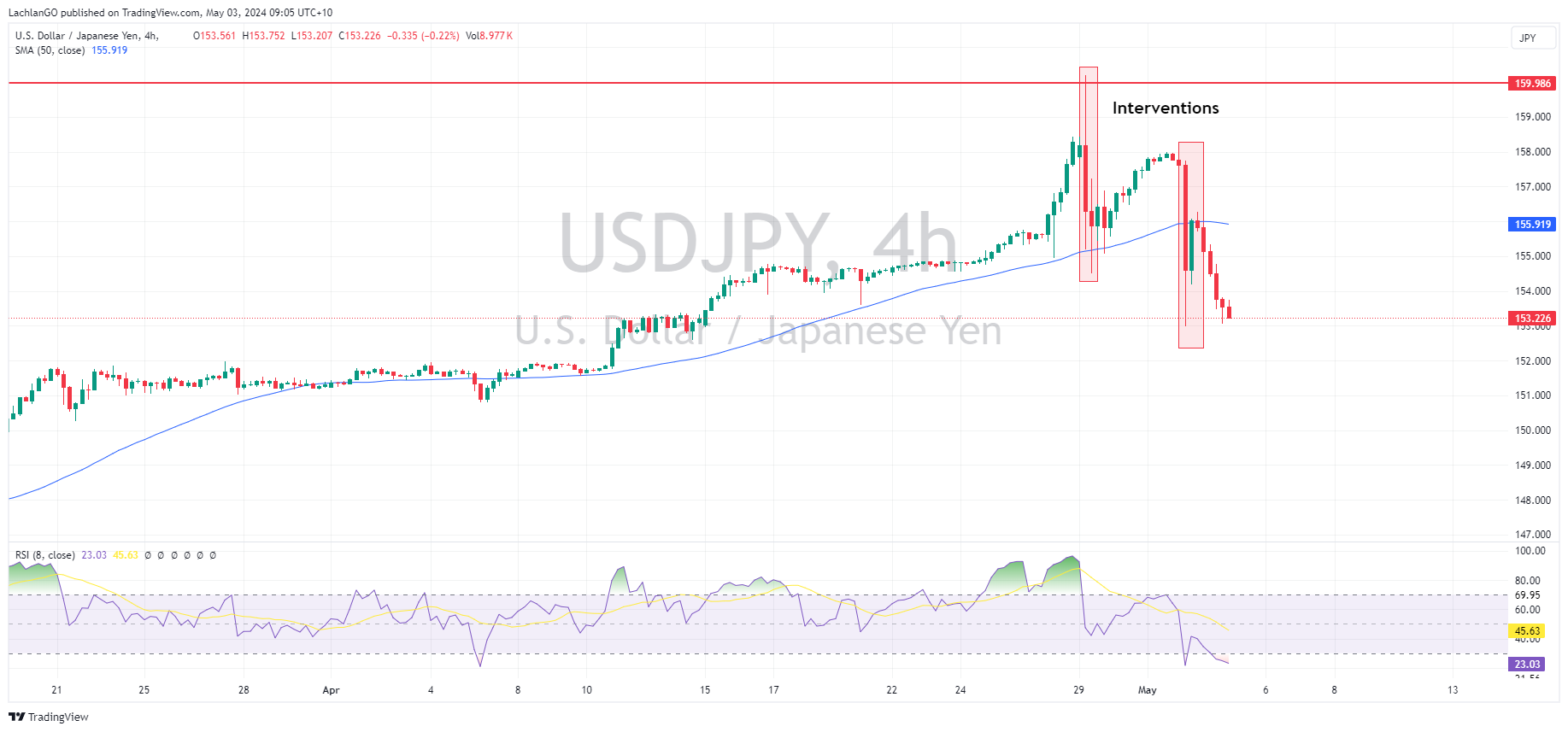

JPY was the clear outperformer of G10 currencies, helped by a Reuters report that BoJ data suggesting that the sharp spikes in Yen strength on Monday and Wednesday this week were indeed BoJ intervention. USDJPY dropping almost 4.5% from the spike high early in Monday’s session to be hovering just above the 153 mark coming in to today’s APAC session.

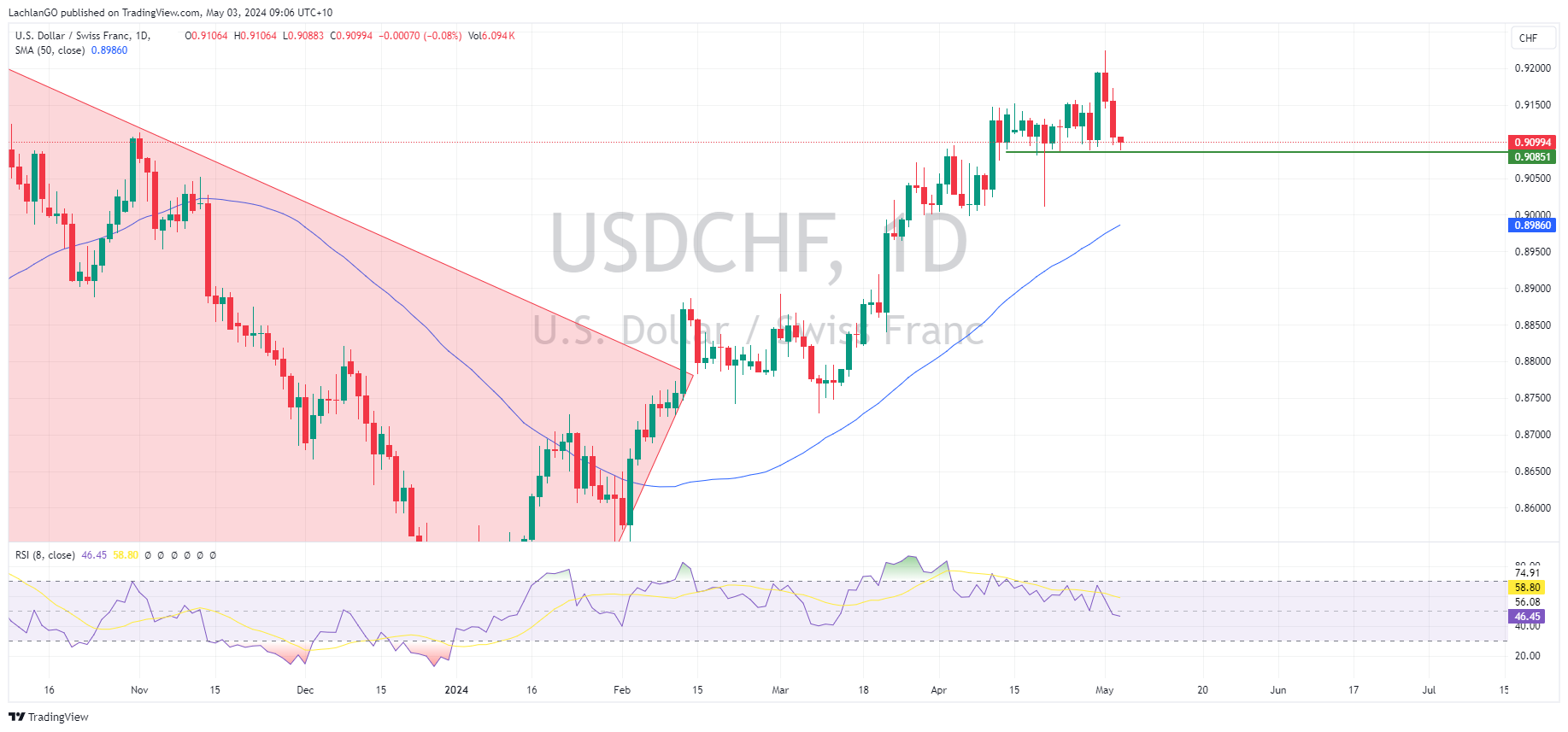

CHF was also an outperformer in Thursday’s session, led higher by a hot April Swiss CPI print where the headline figure of 1.4% Y/Y was well above the expected 1.1%. USDCHF dropped to a low of 0.9094 before finding some buyers at the April support level of 0.9085, this will be a key level to watch in this pair ahead oh US NFP later today.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Future metals: are we seeing the 2000s again?

Plenty has been made of the drive towards nickel and lithium as “future metals” as the world's “electrification” takes hold. This “electrification” has been nicknamed the “volt revolution” and when you get these kinds of technological leaps - what's appearing to be the “winner” now doesn't necessarily mean it will be the overall...

May 7, 2024Read More >Previous Article

Inside the Fed

Let us open with this: “It’s unlikely that the next policy rate move will be a hike. I’d say it’s unlikely,” – US Chair Jay Powell Th...

May 2, 2024Read More >Please share your location to continue.

Check our help guide for more info.