- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Cryptocurrency

- European and US markets hit all time highs, Bitcoin breaks out, the Dollar slides

- Home

- News & analysis

- Cryptocurrency

- European and US markets hit all time highs, Bitcoin breaks out, the Dollar slides

News & analysisNews & analysis

News & analysisNews & analysisEuropean and US markets hit all time highs, Bitcoin breaks out, the Dollar slides

16 April 2021 By Lachlan MeakinEquity markets

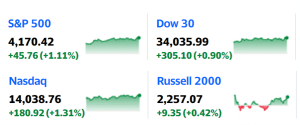

US stocks jumped overnight to reach record levels as stronger than expected print on retail sales and a sharp improvement in the number of new jobless claims cheered the investors.

Source: Yahoo Finance

US reporting season kicked off this week with impressive results so far from Finance heavyweights JP Morgan, Goldman, BOA and Citi, all handily beating estimates.

The week’s economic figures, strong corporate earnings and comments from Fed Chairman Powell regarding the commitment of the central bank’s easy money policies have seen US markets make all time highs on an almost daily basis.

European stocks also hit record highs this week with the EUROSTOXX 50 breaking 4000 and having rallied nearly 80% from the pandemic lows in March 2020.

Analysts are confident there is further upside in Europe as prices remain low compared to the U.S and vaccination rates climb to catch up to the U.S.

“European equities are set to benefit from a sharp acceleration in euro area GDP (gross domestic product) growth over the coming months, but that is due to the boost from reopening and the support from a powerful U.S. recovery, rather than a function of the dispersal of NGEU funds,” two analysts at Bank of America said in a note to clients.

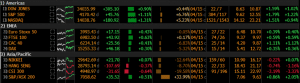

World equity indices are mostly up for the week with only Asian indices lagging.

Traders will be watching today’s upcoming Chinese figures, including the all-important GDP figure, which is expected to be the highest quarterly economic growth since it began releasing such figures 30 years ago.

Source: Bloomberg

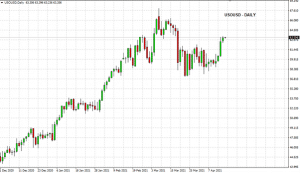

Forex markets

The US dollar weakened dramatically during the week, under performing all major currencies bar the Canadian dollar. Despite a strong week in Oil, current COVID lock down measures in Canada are causing a headwind for the Loonie.

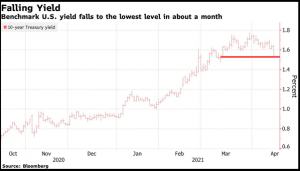

Source: Bloomberg

The recent run up in the US dollar index in tandem with rising 10 year bond yields has reversed in April as yields stabilise and are starting to decline. Overnight 10 year Treasury yields dropped to 1.57%, its lowest level in a month.

Source: Bloomberg

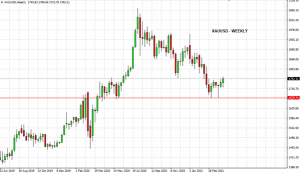

Source: GO MT4

Commodities

Gold

Spot gold (XAUUSD) rallied this week on the back of a weaker US dollar.

US CPI figures also came in higher than expected this week, giving gold an extra boost as it is seen as a traditional inflation hedge.

Source: GO MT4

Oil

US crude prices rallied strongly this week on continued expectation of a global economic recovery.

Agreed production cuts have also given Oil a boost as OPEC is holding back just over 7 million barrels per day, with Saudi Arabia voluntarily cutting an additional 1 million barrels per day.

From next month OPEC+ will start gradually curbing production cuts. In May OPEC+ will allow an additional 350,000 barrels per day to join the markets.

Source: GO MT4

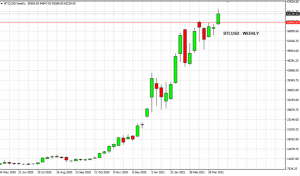

Bitcoin

The highly anticipated Coin base (COIN) IPO launched this week, with investors piling into the new stock.

This mainstreaming of cryptocurrencies in general and Bitcoin in particular saw strong buying in Bitcoin pushing it through the 60k resistance level and hitting all time highs just short of $65k USD.

Source: GO MT4

Monday, 19 April 2021

Indicative Index Dividends

Dividends are in PointsASX200 WS30 US500 US2000 NDX100 CAC40 STOXX50 0 0 0 0.005 0 2.808 1.234 ESP35 ITA40 FTSE100 DAX30 HK50 JP225 INDIA50 0 79.017 0 0 0 0 0 Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Netflix Q1 numbers are in

Netflix reported their Q1 earnings after the closing bell on Tuesday. The online streaming service reported total revenue of $7.16 billion in Q1 beating analyst forecast of $5.77 billion. Earnings per share were reported at $3.75 vs. $2.98 estimate. With both revenue and earnings per share higher than analysts' expectations, the new paid subs...

April 21, 2021Read More >Previous Article

NIO and Sinopec partnership announced

Last week marked a significant milestone for NIO when it produced its 100,000th electric vehicle. The latest development also caught the eye of Tesla ...

April 16, 2021Read More >Please share your location to continue.

Check our help guide for more info.