- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Cryptocurrency

- DOW hits all time highs, Nikkei back to bubble era prices and Bitcoin’s wild ride.

- Home

- News & analysis

- Cryptocurrency

- DOW hits all time highs, Nikkei back to bubble era prices and Bitcoin’s wild ride.

News & analysisNews & analysis

News & analysisNews & analysisDOW hits all time highs, Nikkei back to bubble era prices and Bitcoin’s wild ride.

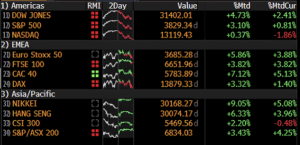

26 February 2021 By Lachlan MeakinGoing into the month’s last day of trading, Global markets have performed well despite a sell off this week. Continued hopes that we’re on a path to economic recovery, with COVID vaccines rolling out and the subsequent drop in cases, have supported markets and drawn in investors.

Global Equities

Major US Indices all saw record highs, with the Dow and S&P500 finishing the month strongly. The tech heavy NASDAQ also hit all-time highs before selling off as investors rotated into traditional cyclical stocks. Tech stocks such as Amazon, Peloton and DocuSign, which all performed well during COVID lockdown measures, dragged down the index as lockdowns started to ease all over the world.

European, UK, Asian and Australian equity markets also performed strongly.

Source: BloombergUS Markets

February saw record highs earlier in the month as COVID vaccinations rolled out out and the Federal Reserve re-iterated its commitment to accommodative conditions until employment and inflation targets are met. Despite these assurances from the Fed there’s been a spike in bond yields which has caused concern for investors in the last days of the month, resulting in a significant sell off in US markets overnight. Investors will be watching this coming into March as any continuation of rising yields will be a negative for equities.

Asian Markets

Asian markets performed strongly in February with the Nikkei being the strongest performer, breaking above 30000 – a level not seen since the bubble era of the 80s/90s.

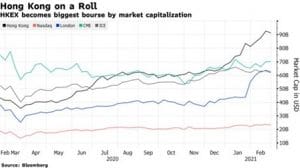

Source: Bloomberg

Hong Kong’s Hang Seng also continued its impressive run. HKEX has seen record volumes on Chinese firms finding a new home there over concerns they’d be booted from US exchanges. HKEX is now the world’s biggest bourse by market value, easily beating rival bourses in London and the US.

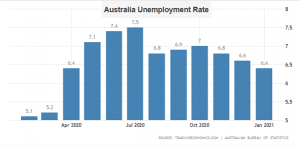

Australia

The ASX 200 has rallied over 3% to date in February. Persistently high commodity prices, an extension in the RBA’s QE bond buying program, and a recovering labour market all supported Aussie equities. COVID vaccinations starting also gave investors optimism for a continuing economic recovery.

Source: tradingeconomic.com

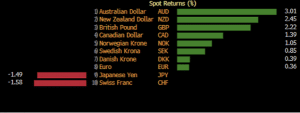

FX market

February saw a mostly weaker US dollar, with the greenback only outperforming safe haven currencies the Swiss Franc and Japanese yen. With equity markets rallying and record commodity prices, risk and commodity backed currencies outperformed, with the AUDUSD breaking decisively through its 2021 resistance level of 78c US.

Source: Bloomberg

British Pound

Despite being neither a risk on nor commodity currency the British pound strongly rallied this month on impressive COVID vaccination progress.

The pound hit its highest level against the US dollar in nearly three years, amid rising optimism about an end to lockdown in the UK.

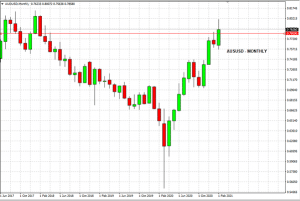

Australian Dollar

The Australian Dollar was the top performing major currency in February. This despite a dip at the start of the month, when the RBA somewhat surprised the market with an announcement of the extension of the 100 billion bond buying program.

Strong signs of recovery in the local labour market, Chinese demand for commodities which are near record highs, and the status of AUD being a ‘risk on’ currency all helped AUDUSD break through the 78c US level. Analysts at ANZ and CBA expect the Australian dollar to trade as high as 82 US cents by the end of the year.

Source: GO MT4

Bitcoin

Bitcoin again proved how volatile it can be with wild swings during the month. The cryptocurrency gyrated wildly from 32k USD at the start of the month, hitting an all-time high above 57K before selling off to be around 47k at the time of writing.

Increased optimism in the institutionalising of Bitcoin as big players such as Morgan Stanley, Bridgewater capital, BNY Mellon and Tesla announced Bitcoin investments drove the price higher as momentum traders jumped on board.

The party was somewhat spoilt by comments from Treasury secretary Janet Yellen who labelled Bitcoin “an “inefficient” digital currency and one that is often used for illegal transactions” Government regulation and banning of Bitcoin is the biggest fear of traders in this market.

Source: GO MT4

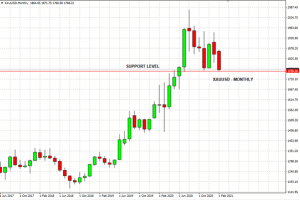

Gold

Spot Gold prices dropped around 5% in February to date as the precious metal came under serious selling pressure. This drop is despite US dollar weakness; as the economic recovery progresses globally, gold’s appeal is waning.

With inflation reportedly low in developed economies gold’s other function as an inflation hedge has also waned. XAUUSD is now testing critical support levels that were set late in 2020.

Source: GO MT4

Monday, 22 February 2021

Indicative Index Dividends

Dividends are in PointsASX200 WS30 US500 US2000 NDX100 CAC40 STOXX50 10.832 8.224 0.097 0.029 0 0 0 ESP35 ITA40 FTSE100 DAX30 HK50 JP225 INDIA50 0 0 0 0 0 0 0.718 Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Dow Jones rally Q1 2021

2021 has been a profitable year for stocks in the Dow Jones Index. Since the turn of the year, the Dow has seen what appears to be a roaring rally with no end in sight, fuelled by a return of investor confidence and a stimulus package aiming to revitalise a stagnant U.S economy. In the first quarter of 2021, we've seen an increase of over 30...

March 17, 2021Read More >Previous Article

US markets again hit all time highs and Gold loses its lustre

Equity markets US markets dipped last night with the Dow finishing down for the first time in 4 sessions. This came as the streak of better-than-...

February 19, 2021Read More >Please share your location to continue.

Check our help guide for more info.