- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Cryptocurrency

- Bitcoin showing early signs of another sell off?

- Home

- News & analysis

- Cryptocurrency

- Bitcoin showing early signs of another sell off?

News & analysisNews & analysis

News & analysisNews & analysisBitcoin had a tumultuous 2022 with the leading cryptocurrency seeing an aggressive sell off. Lead by catalyst such including the collapse of Celsius and exchange FTX, the price of the dropped 65% from 50,000 USD to $17,000. The collapse of the large players within the cryptocurrency sphere sent shockwaves as institutions and retailers pulled their funds from the sector. Further threats of more regulation also threw shade at the legitimacy of the current market and the future ability of the market to operate at the status quo.

In more recent times, the price of Bitcoin has not found any significant support and there is no evidence to suggest that in the short term a reversal or a long opportunity will arise. Consequently, traders should be looking at upward price movements as opportunities to entre short until a true reversal is validated.

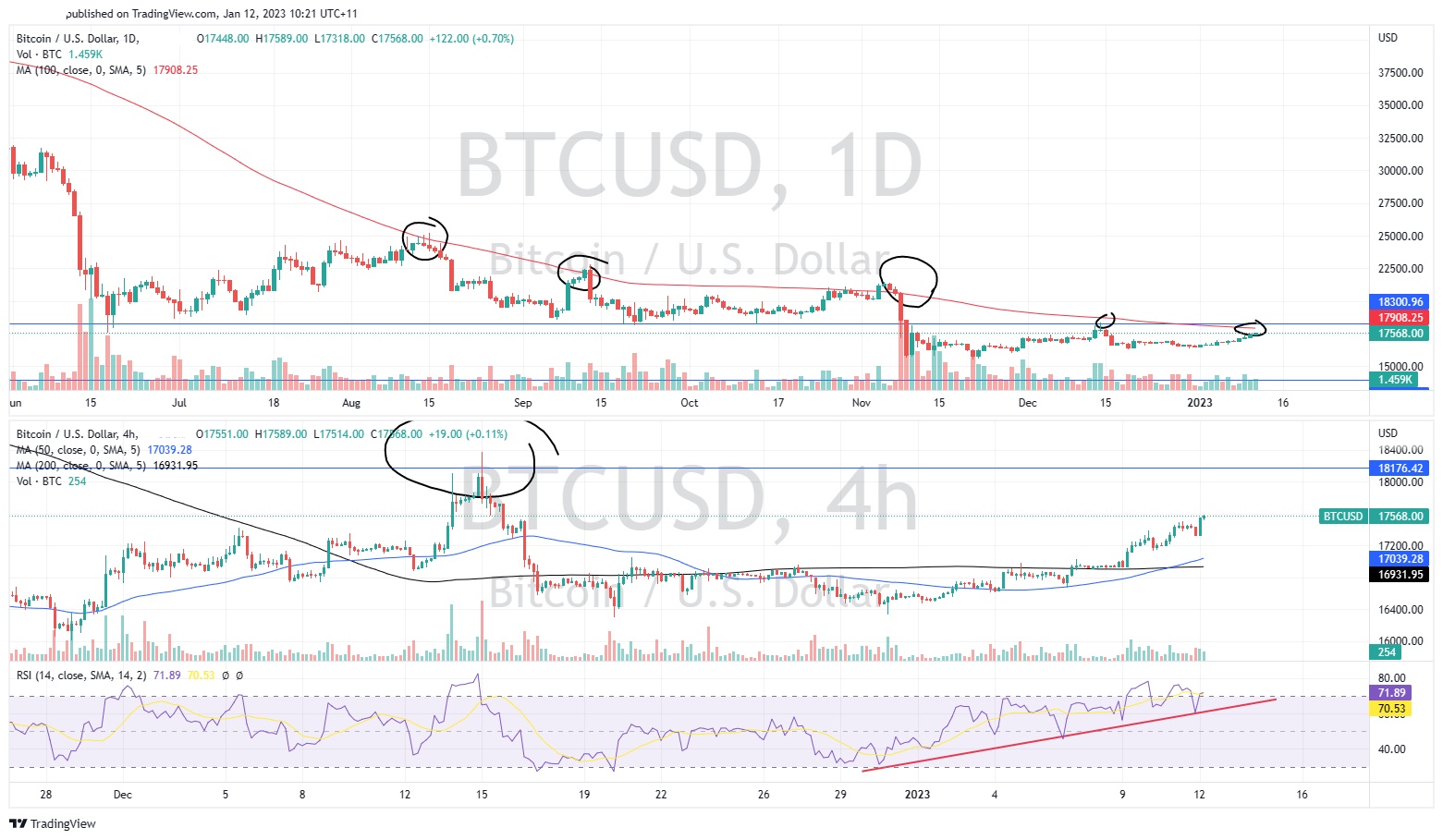

By looking at the daily chart the price has respected the 100-day moving average. On the prior 4 occasions in which the price has tested this resistance it has failed to break out. Each time the rejection has been accompanied by aggressive bearish candlesticks. These were sometimes supported by large sell volumes but not always. Using this 100-day moving average line as resistance and waiting for a bearish candle represent a possible short opportunity. This is roughly at $17,900 USD. The short side target is the break is $15,500 for the first level and then if it breaks through the next support is at $14,000.

Looking at the 4-hour chart the price shows that it is still trying to move up with some continuing momentum. Waiting for the 4-hour chart to show some weakness in terms of selling volume or a bearish sequence may provide the entry trigger for a short entry. Furthermore, the RSI is still in an uptrend. If the RSI breaks to down the side, it may provide some further confirmation of a bread down of the price.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

TSMC posts strong Q4 results – the stock is rising

TSMC posts strong Q4 results – the stock is rising Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) reported Q4 financial results before the market open in the US on Thursday. The Taiwanese company reported revenue of $20.554 billion for Q4, falling slightly short of Wall Street estimate of $20.574 billion. TSMC reported ea...

January 13, 2023Read More >Previous Article

What is going on with Tesla’s share price?

What is going on with Tesla’s share price? Tesla is now one of the world’s most recognisable brands and companies. A leader in technology and pio...

January 10, 2023Read More >Please share your location to continue.

Check our help guide for more info.