- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Articles

- Central Banks

- Reserve Bank of Australia hikes Cash Rate by 0.50%

- Home

- News & analysis

- Articles

- Central Banks

- Reserve Bank of Australia hikes Cash Rate by 0.50%

News & analysisNews & analysis

News & analysisNews & analysisThe Reserve Bank of Australia, (RBA) has increased the Country’s cash rate by half a percent to combat the rising inflation in its latest cash rate change. The increase was in line with most analyst’s expectations as the RBA continues to fight inflation and bring it back into the 2-3% range. The current forecast from the RBA suggests that CPI inflation will peak near 7.75% over 2022, before falling to 4% during 2023, and then settling at 3% in 2024.

A key source of concern for the RBA was and continues to be the current spending habits of Australian households. Importantly, as the cost of goods has risen due to inflation, pressure has built on household budgets and their spending habits. This has been caused by both the supply chain issues and the increased cash rate. Furthermore, consumer confidence has fallen, and “housing prices are declining after the large increases in recent years.” This shows how interest rate hikes are impacting the lives of Australians and their spending habits.

Another important factor at play is the tightening of the job market. The unemployment rate dropped in June to 3.5%, the lowest rate in 50 years, and job vacancies and job advertisements continue to be at high levels. However, the bank does not expect to be able to hold these levels and predict the rate of unemployment will reach 4% by the end of 2024 as a result of the current slowing economic growth.

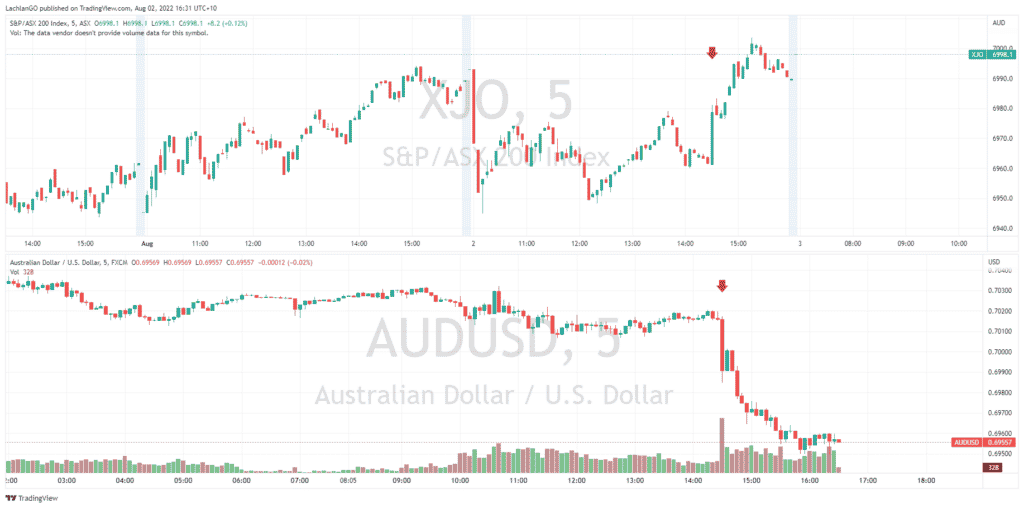

In response to the announcement, the ASX200 responded positively as investors saw the announcement as bullish, shooting up 0.38% in the 30 minutes after the announcement. Conversely, the AUDUSD dropped back below $0.70 dropping to $0.6970 in the 30 minutes immediately after the announcement.

The RBA will later this week further update the market with its monetary policy statement which will provide further clarity on its decision-making and the current sentiment.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

PayPal Q2 earnings results are here

PayPal Holding Inc. (PYPL) announced its latest financial results after the closing bell in the US on Tuesday. The US financial technology company reported revenue of $6.8 billion in Q2, topping Wall Street estimate of $6.778 billion. Earnings per share also beat analyst estimates for the quarter at $0.93 per share vs. $0.87 per share estimat...

August 3, 2022Read More >Previous Article

RBA preview – likely 50bp hike incoming

Todays RBA policy meeting is expected by most analysts to result in a 50bp hike as the bank tries to play catch up and get on top of elevated inflatio...

August 2, 2022Read More >Please share your location to continue.

Check our help guide for more info.