- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Central Banks

- Non-Farm Payrolls Preview – Charts to watch – DXY – US10Y

- Home

- News & analysis

- Central Banks

- Non-Farm Payrolls Preview – Charts to watch – DXY – US10Y

News & analysisNews & analysis

News & analysisNews & analysisTodays NFP figure out of the USA is shaping up to be a pivotal moment in market expectations as to whether we’ve seen peak rates from The Federal Reserve, or if there is more to come and the ramifications that will have for the FX market.

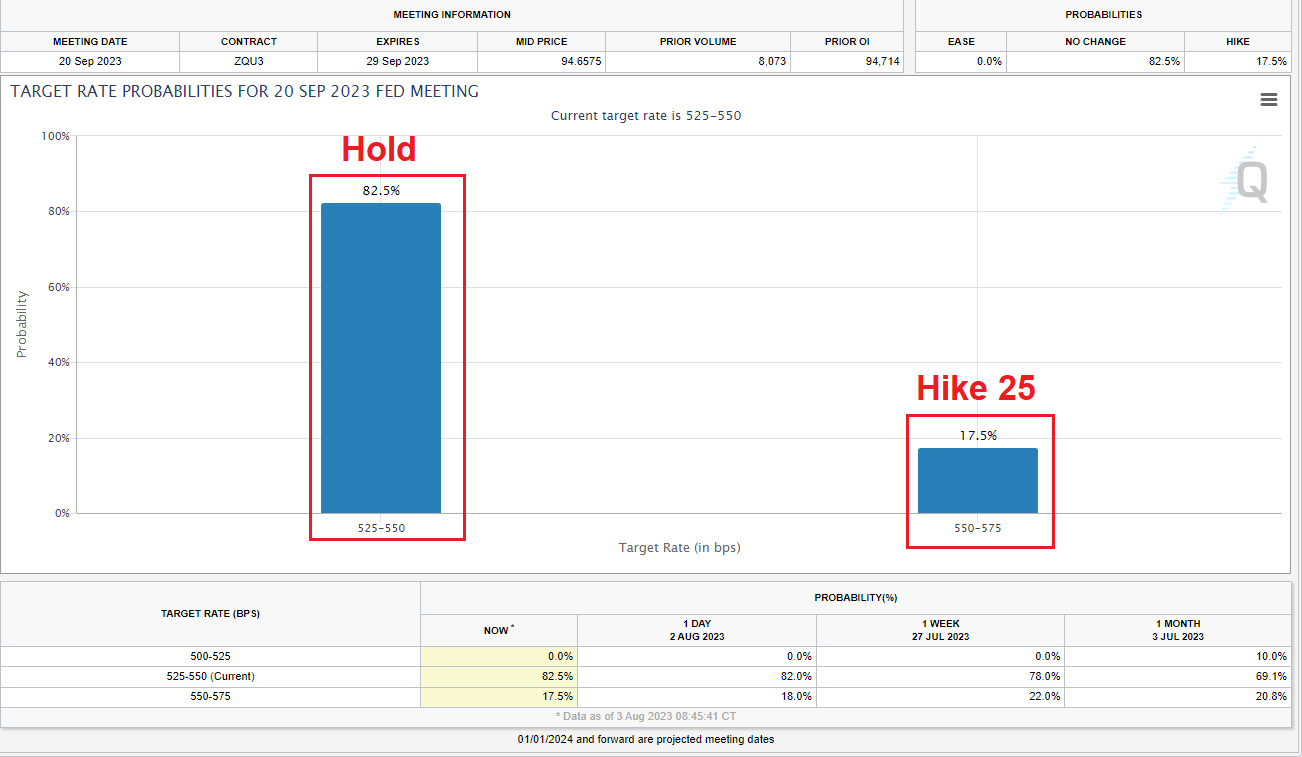

NFP figures are always interesting, traditionally the biggest market moving figure of the month on the US calendar, and against the backdrop of the Feds “data dependent” messaging regarding future rate moves this figure will be a big piece of how the market prices in the result of the September Fed meeting. Currently markets are butting heads with the Fed, only pricing in a higher chance of no more hikes from the Fed, despite Fed guidance and dot plots indicating they are looking at least one more hike this cycle. Current September Fed Fund Future odds are showing only a 17.5% of a hike in the September meeting.

Source:CME Fedwatch tool

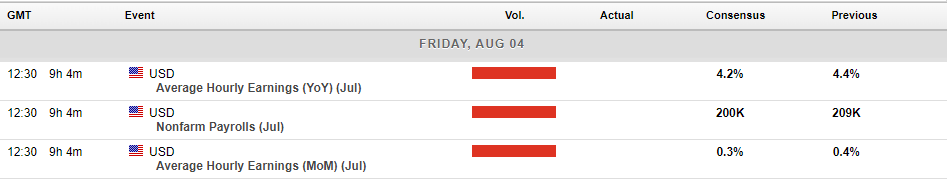

Market expectations are for a slowing in payroll growth in July the consensus being 200k nonfarm payrolls to be added to the US economy in July, slightly cooling from the 209k added in June, with the unemployment rate expected to remain unchanged at 3.6%. A big beat or miss on these expectations, a rapid repricing of hike/hold odds would be likely to see volatility and opportunities in FX markets.

Chart to watch:

US Dollar Index (DXY)

DXY has rallied strongly since mid-July as the UST 10 Year yields pushed higher and getting an extra boost from some risk-off this week in equity markets which pushed DXY through the S/R level at 102. DXY found resistance at its upper trend line at around the 102.84 level, seeing some of the recent gains being pared. Also an important factor is the close relationship between US10 yields and DXY, the yields now above 4% where they have struggled to go any higher in the recent past, this will also see a headwind against DXY pushing higher from this level. The levels to watch over todays NFP will be 102.84 to the upside on a big beat, 102 as support to the downside if we get a big miss. Both of those levels will be key in the next trend direction of DXY.

Calendar:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Share Buybacks: A Double-Edged Sword for Investors?

Share buybacks refer to the practice where a company purchases its own shares from the open market or directly from its shareholders. In practice this results in a reduction in the number of outstanding shares available in the market, and so buybacks can also have an impact on the stock's price, as the reduction in supply can drive up demand a...

August 7, 2023Read More >Previous Article

Averaging down: A Risky Move or a Smart Strategy?

Averaging down is an investment strategy in which an investor purchases additional shares or other assets at a lower price than their initial purchase...

August 3, 2023Read More >Please share your location to continue.

Check our help guide for more info.