- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Central Banks

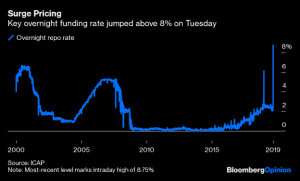

- Fed in Focus – US Repo and Funds Rate

News & analysisFed in Focus – US Repo and Funds Rate

During the week, it was all about the Repo market. A Repurchase Agreement known as Repo is a form of short-term borrowing for dealers in government securities. The Repo market plays a key role in supporting liquidity in the financial markets. It facilitates the flow of cash and securities around the financial system which benefits both the financial and non-financial firms.

Repo Market Explained

In simple words, the Repo market consists of one party lending out cash in exchange for an equivalent value of securities to another party. The Borrower will, therefore, pay a fee to the Lender. The securities being sold, which is often the Treasury notes are the collateral.

Such transactions allow companies that own lots of securities but are short of cash to cheaply borrow money from parties that own lots of cash. As the collateral are government bonds, the risks are generally low.

US Borrowing Costs Soared

On Tuesday, the Repo rate soared to record levels above 8% which is more than four times the normal rate. Even though the money market experienced a significant outflow on Friday ahead of the tax deadline, the sharp increase stunned investors and created fears of the abrupt tightening of the US money markets.

There was another alarming signal as the surge in the Repo rate caused the average funds rate to rise to the upper end of the Fed’s current target range. The Fed quickly intervened with a move it has not used in more than a decade and injected billions of dollars in the financial system to calm money markets.

The move succeeded in bringing some relief and allowed the Repo rate to drop. The Fed further reassured market participants that it is willing to spend another $75 billion on Wednesday.

Bad Timing

At a time where there are deep disagreements within the Federal Reserve over the path of interest rate outlook, the chaos in the repo markets complicated matters. Investors have priced-in a 25-basis point rate cut, but are uncertain about the future “dot plot”.

The manufacturing sector is slowing, and trade tensions continue to overshadow the financial markets. However, the consumer-orientated parts of the economy are holding up. Consumers remain one of the bright spots – Personal Consumption grew at a healthy pace in July. The employment sector also remains strong.

Hawkish Rate Cut

This meeting will help traders to gauge how policymakers are assessing the recent economic data and the trade tariffs developments. There have been some sorts of a rethink in the markets regarding further easing.

Do the current economic conditions justify more rate cuts?

At this stage, the economic data does not fully justify the second-rate cut, but the Fed will likely proceed with the cut as insurance against slowing growth due to external factors rather than a slowing domestic economy.

Irrespective of how the Fed conveys its monetary outlook, the Fed is set to trigger high volatility!

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Margin Call Podcast – S2 E6: Martin North | Principal of Digital Finance Analytics

Martin North is the Principal of Digital Finance Analytics, a boutique research, analysis and consulting firm. This former consultant of Booz Allen & Fujitsu Australia pedigree is well known for his level-headed approach to financial markets & the economy. His Walk The World channel on YouTube is a must for astute economy watchers in Au...

September 19, 2019Read More >Previous Article

Six Steps to Improve Trading Discipline – #1 Awareness

With very rare exceptions every trader must battle with trading discipline at stages in their trading career. Commonly when we explore t...

September 18, 2019Read More >Please share your location to continue.

Check our help guide for more info.