- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Central Banks

- Central Bank Interest Rates

News & analysis

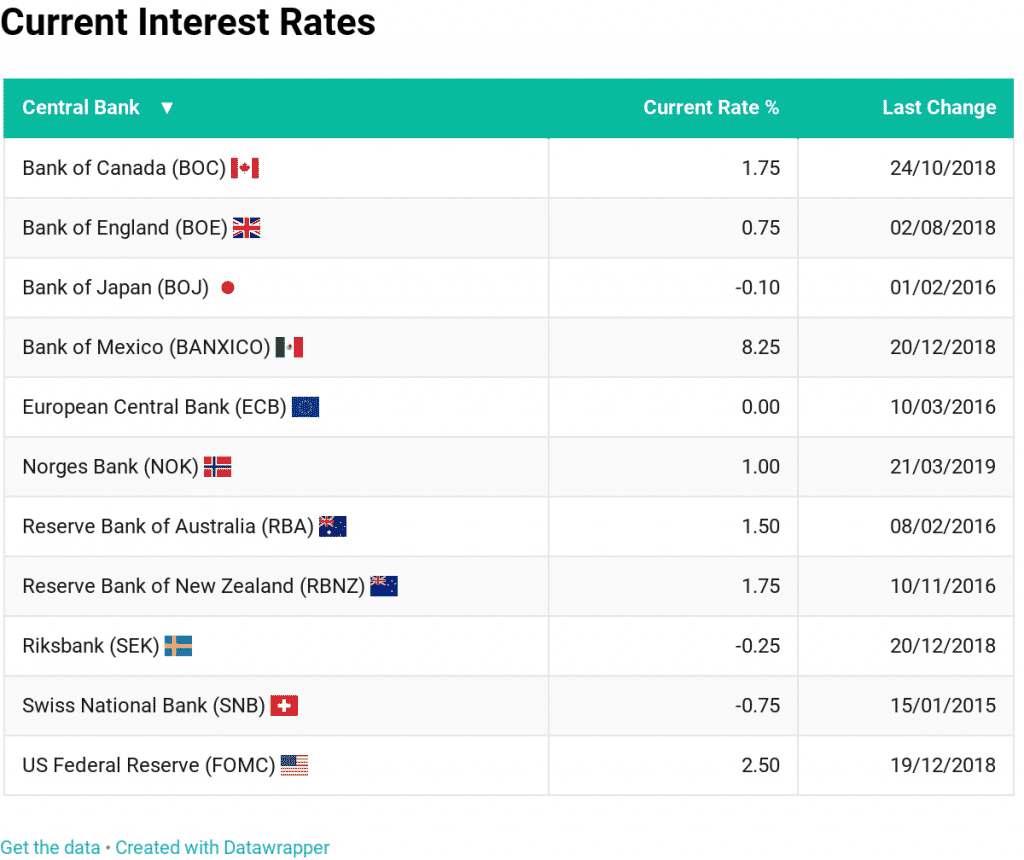

Today, the Bank of Canada announced its decision to leave interest rates unchanged at 1.75% and with other major central bank policy meetings due to take place in the coming weeks, there is no better time to look at the current interest rates of some of the major central banks from around the world.

About Interest Rates

A bank interest rate is a rate at which a countries central bank lends money to local banks. The interest rate is charged by nations central or federal bank on loans advances to control the money supply in the economy and the banking sector.

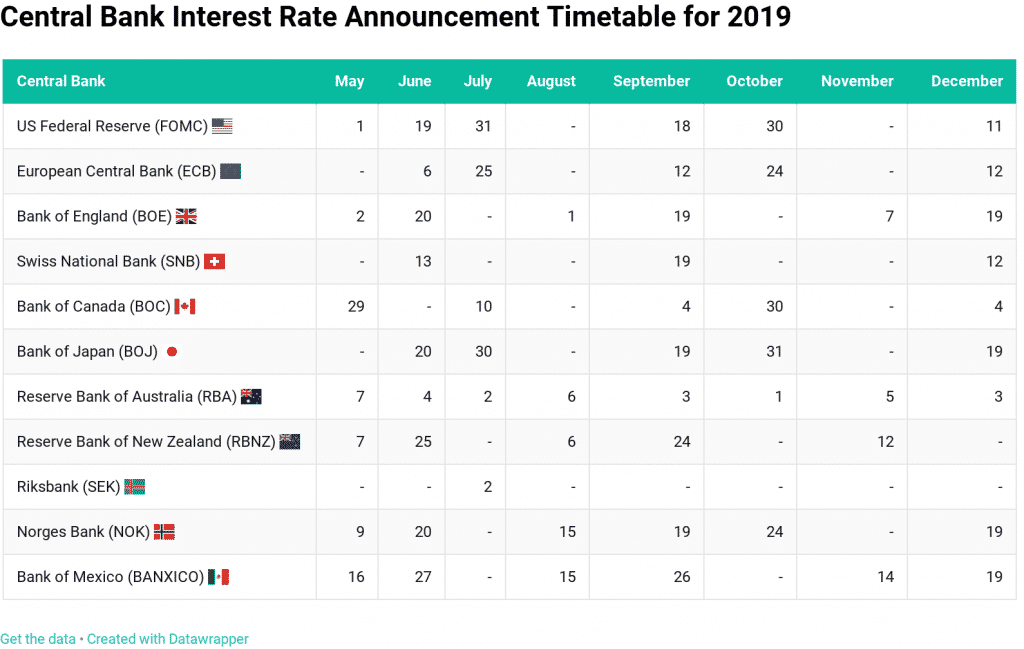

Each central bank has their own timetable for the year when they announce the key interest rate and it is important to keep an eye out for these announcements as the volatility in the market increases, especially if there is an unexpected rise or decrease in the interest rates.

It also has an impact on the day to day lives as it determines what you pay for borrowing money and what the bank will pay you for saving money. Interest rates are shown as a percentage of what amount you borrow or save and is paid as interest over the course of a year.

Recent Rate Hikes

The most recent central bank to announce a rate increase was the Norwegian Central Bank (Norges Bank) last month when the rates were raised to 1% from 0.75%, the first hike since September 2018.

We also saw the US Federal Reserve raise its interest rates four times in 2018, with the latest hike back in December when the rates were increased from 2.25% to 2.50%. It was the 9th time since the financial crash in 2008 the rates were increased.

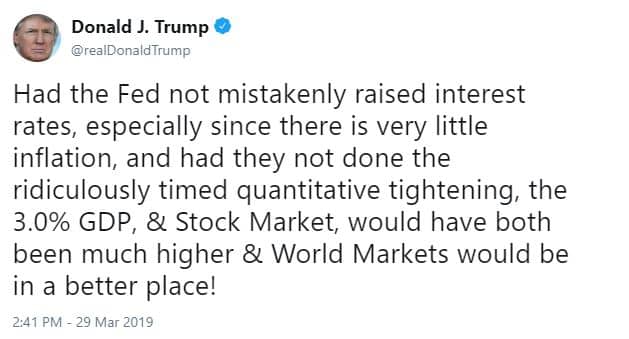

There is one person in particular, who is not happy about the rate hikes from the Fed and that is the US President Donald Trump, who has voiced his dissatisfaction via Twitter numerous times, stating that the most recent rate hikes were a mistake.

Next up, we have the US Federal Reserve (FOMC) and the Bank of England (BOE) rate decisions on 1st and 2nd May respectively. For a full schedule for all the major central banks, see the table below.

To keep up to date with the upcoming economic events click here for our Economic Calendar.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Source: Global Rates, Twitter, Datawrapper

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Preview: Bank of England Rate Decision

Brexit has been dominating the news flow in the United Kingdom for a long time, but on Thursday all eyes will be on the latest Bank of England rate decision. The decision is set to be announced at 12 PM London time. About Interest Rates Interest rates are set by the Bank of England’s Monetary Policy Committee which is made of nine members �...

May 1, 2019Read More >Previous Article

Up Next: The Bank of Canada Rate Decision

One of the must-watch economic events this week will be the Bank of Canada interest rate decision. The decision is scheduled to be announced on Wedn...

April 23, 2019Read More >Please share your location to continue.

Check our help guide for more info.