- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Central Banks

- AUD/USD’s reaction to the yesterday’s RBA interest decision

- Home

- News & analysis

- Central Banks

- AUD/USD’s reaction to the yesterday’s RBA interest decision

News & analysisNews & analysis

News & analysisNews & analysis

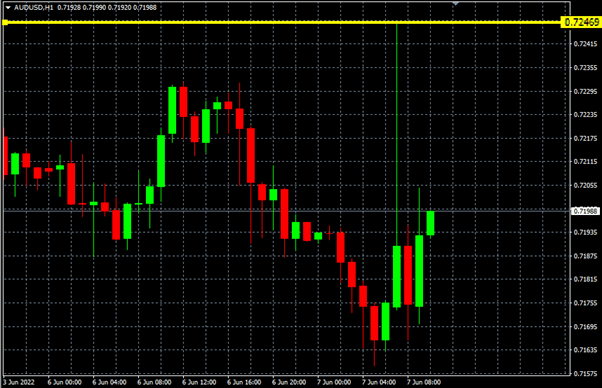

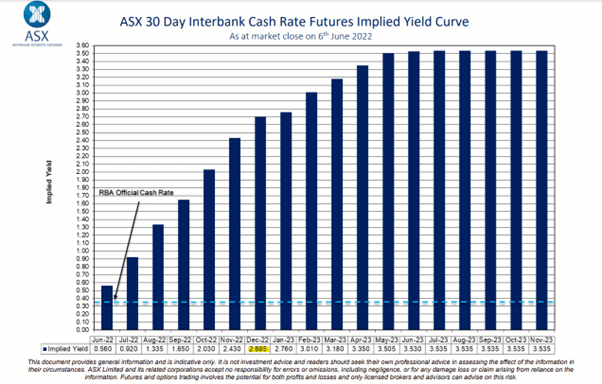

The AUDUSD pair has reached an intraday peak of 0.72469 following the RBA decision. The buying action was spurred on by Aussie bullish investors after the RBA decided to increase the interest rate by 50 basis points to 0.85%. This increase was higher than the consensus of 25 basis points.

The RBA is on track to raise the interest rate a few more times before the end of the year. The general consensus by experts and traders is that the interest rate will reach 2.70% by year’s end. Yesterday’s interest rate hike is already ahead of consensus of 0.55%, this could mean that the increase is happening faster than expected.

However, the price did not last long at the peak. It was brought back to the previous price points due to a few factors. The AUDUSD reversed its big gains within the hour could be due to investors becoming cautious ahead of the US inflation scares and wanting to transfer their funds back into USD.

Another reason could be coming from the Australian payroll data for the month of April. The Australian labour department has reported an addition of 4,000 jobs in April, which is lower than the forecast of 30,000. These figures would usually trigger recession fears within the Australian economy. As the RBA looks to impose a policy tightening approach, companies will be forced to be critical on their investment opportunities. This can lead to a further slippage for employment changes.

Meanwhile, the US dollar index (DXY) has extended its gains and has overstepped its previous two week’s high at 102.73. Uncertainty over the release of Friday’s US Consumer Price Index (CPI) is supporting the DXY. A preliminary estimate for the annual US inflation is 8.2% against the prior print of 8.3%. A minor slippage in the US inflation is not going to exhaust the momentum of the DXY bulls but will bolster the odds of a consecutive jumbo rate hike by the Federal Reserve (Fed) next week.

If you are keeping an eye on the AUDUSD and would like to take the opportunity to trade this pair and not yet have a trading account, you can register for a GO Markets CFD account.

Source: GO Markets, ASX, RBA, AFR, Fxstreet

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

NIO Q1 results announced

NIO Inc. (NIO) reported its first quarter financial results before the market open in the US on Thursday. The Chinese electric vehicle maker reported revenue of $1.563 billion in the first quarter (up by 24.2% year-over-year), topping analyst estimate of $1.561 billion. Loss per share reported at -$0.12 per share, lower than the -$0.15 loss p...

June 10, 2022Read More >Previous Article

Blackstone Mineral garners interest from Vietnam’s biggest conglomerate

Blackstone Minerals Limited’s Ta Khoa project is drumming up a lot of interest among banks and analysts who have recently taken a tour of the si...

June 7, 2022Read More >Please share your location to continue.

Check our help guide for more info.